How much can i borrow with a fha loan

When you sell your home for the appraised fair market value the. Its easy to assume that the kind of home you can buy is a single-unit residence but FHA home loan.

Fha Loans Requirements Documentation And Calculator

How expensive of a home can I afford with an FHA loan.

. How much house can I afford with an FHA loan. Browse through our frequent homebuyer questions to learn the ins and outs. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

Fees are added. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living. Total subsidized and unsubsidized loan limits over the course of your entire education include.

Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI. Remaining balance of the loan is paid by mortgage insurance. Todays national FHA mortgage rate trends.

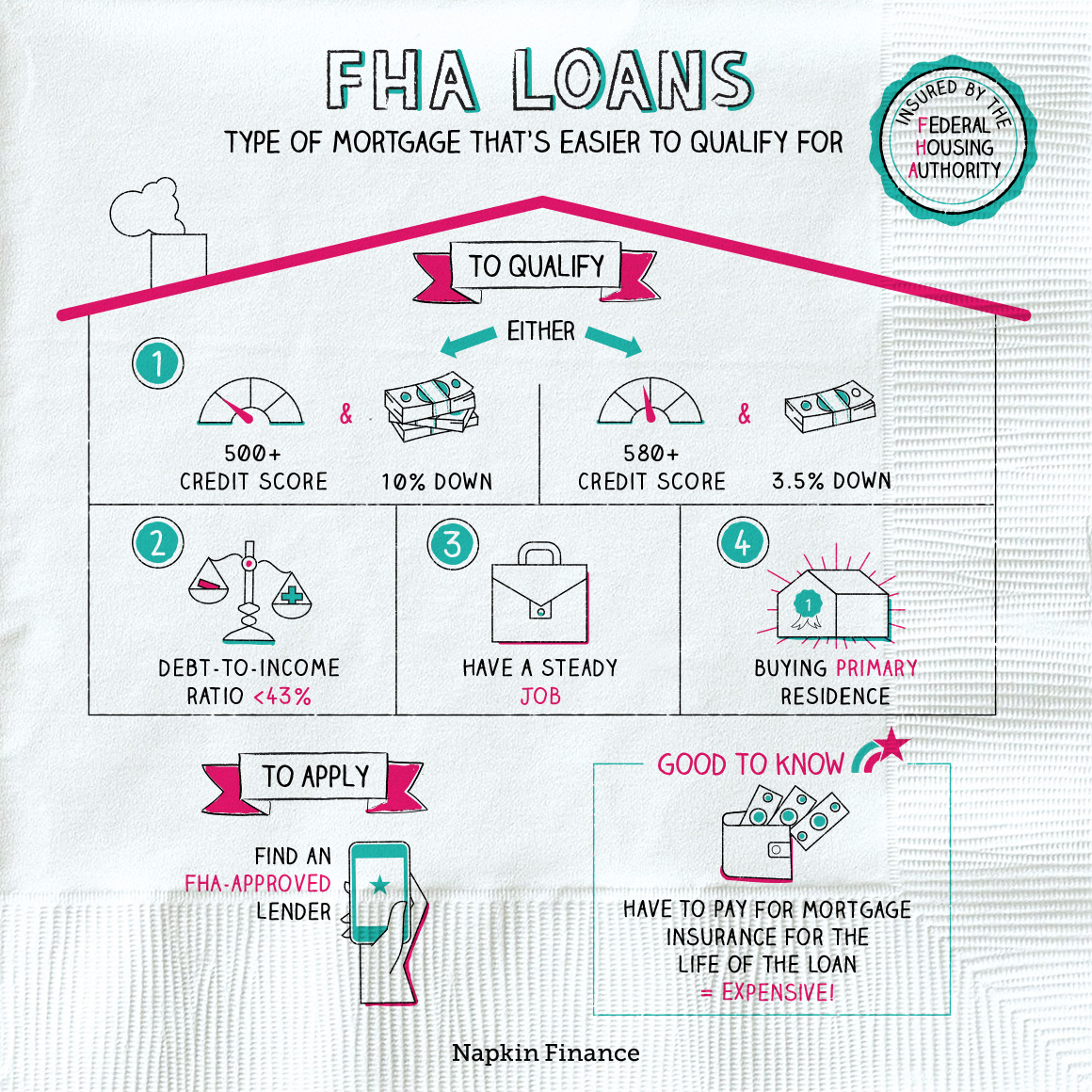

Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases. FHA-insured loans are meant to help people with low or no credit high debt or low funds qualify for a mortgage.

For today Thursday September 15 2022 the national average 30-year FHA mortgage APR is 6290 up compared to last weeks of 6180. FHA Loan Programs for 2022 The most recognized 35 down payment mortgage in the country. FHA mortgage loans are available for much more than just suburban homes or condominiums.

The maximum term is 15 years for a lot-only purchase. Mortgage loan basics Basic concepts and legal regulation. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment.

This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things. That term can be extended up to 25 years for a loan for a multi-section mobile home and lot. An FHA loan for example may have different fees depending on whether youre applying for the loan through a local bank credit union mortgage banker large.

You can get one with a down payment as low as 35. Manufactured homes are often sold and transported in sections to be assembled on-site. 1 How much income you need to qualify for the mortgage or 2 How much you can borrow or 3 what your total monthly payment will be for the loan.

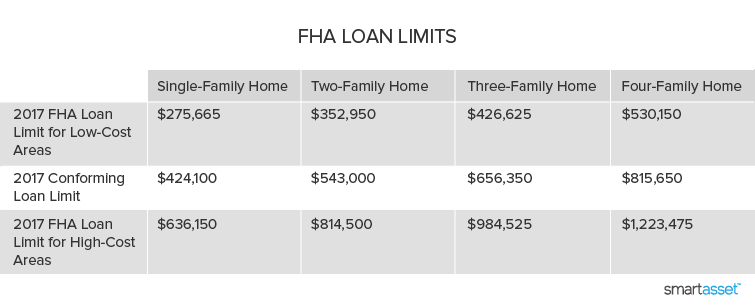

Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. If your repairs are on a single-family home and are going to cost more than 25000 the FHA offers 203k loans that allow you to borrow up to 35000 for short-term home repairs and up to 110 of the homes value after the repairs are completed for more substantial repairs. There are different FHA loan limits for single-family and duplex-style properties.

Most mortgages have a loan term of 30 years. In the end when making the decision to acquire a property the borrower needs to consider various factors. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Condos manufactured homes even new construction which is much simpler these days thanks to the One-Time Close option available from some participating FHA lenders. Keep in mind that generally the lower your credit score the higher your interest rate will be which may impact how much house you can afford. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

FHA loans can also be used to purchase manufactured homes andor modular homes. If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

FHA lenders are limited to charging no more than 3 to 5 percent of the loan amount in closing costs and the FHA allows up to 6 percent of the borrowers closing costs such as fees for an. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. FHA loans are restricted to a maximum loan size depending on the location of the property.

First the borrower should know what the lender believes the borrower can afford and what size of a mortgage the lender is willing to give. FHA One-Time Close Loans. Simple Refi FHA Reverse.

Second mortgage types Lump sum. FHA calculators let homebuyers and homeowners understand what they can afford to safely borrow to finance a home. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

Second mortgages come in two main forms home equity loans and home equity lines of credit. Theres a wide variety of properties a house hunter can purchase with an FHA mortgage. Ideally you want to save at least a 20 down payment.

How Much Money Can I Afford to Borrow. Ability to Borrow Loan Affordability Loan Payments. This mortgage calculator will show how much you can afford.

To the loan each month Your loan balance is more than the. If your loan balance is more than the value of your home you may not have to pay. Fees can be surprisingly varied.

Home buying with a 70K salary. FHA loan is a mortgage that is insured by the FHA and issued by a bank or other. FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND HOME-AND-LOT.

Streamline Refi Cash-out Refi Rehab Loan. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. 31000 23000 subsidized 7000 unsubsidized Independent.

Since 2010 20-year and 15-year. Formulas are used to get. But keep in mind that you would have to refinance in order to use the 203k loan on a.

Purchase or refinance your home with an FHA loan. To buy a house you can afford never buy one with a monthly payment thats more than 25 of your monthly take-home pay on a 15-year fixed-rate conventional loan stay away from FHA and VA loans. The Federal Housing Administration home loan program has limits to how much you can actually borrow.

These limits vary by county because they are based on median home prices which also vary by location. Most future homeowners can afford.

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Minimum Credit Scores For Fha Loans

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Requirements And Guidelines

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loans Everything You Need To Know

Fha Loans Napkin Finance

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loans Complete Guide For First Time Homebuyers Credible

7 Crucial Facts About Fha Loans Las Vegas Review Journal

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Fha Loan What To Know Nerdwallet

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loan Limits 2022 Update With County Maximums Smartasset Com

Let S Talk Loan Options Fha Loan Total Mortgage Blog

What Makes Fha Loans Different From Other Loans Regentology